Following the May 2015 election, the UK government has commenced a wholesale reform of the way in which renewable energy is supported and incentivised in the UK.

This reform appears to have been shaped by a drive to slash costs and, as with the early closure of the Renewables Obligation (RO) to large solar PV generating stations (LSGS) (generating stations with an installed capacity greater than 5 MW) in March 2015, the proposed changes are likely to lead to a short-term boom in renewables deployment, followed by a run-off period where fewer generating stations are accredited under specific time-limited exemptions (commonly referred to as grace periods).

In all cases, the proposed changes present a profound challenge to not only the renewables sector, but also to the UK’s future energy requirements and need to be understood by every stakeholder.

This article seeks to give a high-level overview of the proposed legal changes to how renewable energy is supported and incentivised, set out some other significant renewables developments and explore the various grace periods (and likely eligibility criteria) that will now become a pivotal factor in the development of most renewables projects.

THE BACKGROUND

The current forms of the RO and Feed-in Tariff (FIT) (the RO and FIT together being the ‘Schemes’) were introduced in 2009 and 2012 respectively to encourage renewable electricity generation, thereby assisting the UK (among other things) to meet its legal commitment under the Renewable Energy Directive to ensure that 15% of its energy demand was met through renewable sources by 2020.

The Renewables Obligation

The RO is one of the mechanisms (the other being Contracts for Difference, which will eventually take over from the RO) designed to support large-scale renewable electricity generation. Through the RO, the government places an annual obligation on licensed electricity suppliers to source a proportion of the electricity they supply to customers from renewable energy sources. These suppliers are required to meet their individual obligation target by purchasing Renewables Obligation Certificates (ROCs) from renewable generators directly and/or from the ROCs market and/or by paying a set amount to government by way of a penalty. Through this mechanism, ROCs have a monetary value (in August 2015 ROCs were trading at around £42.00-£42.50 per ROC) and generators have been able to sell (among other things) the electricity generated by their renewable generating stations (and associated ROCs) to licensed electricity suppliers.

The Feed-in Tariff

The FIT is a mechanism that supports small-scale (5MW or below) renewable electricity generation. Through the FIT, renewable generators are paid a fixed (indexed linked) amount per kilowatt hour of electricity that their generating station generates (the generation tariff) and a fixed (indexed linked) amount per kilowatt hour of that electricity that is exported to the local electricity distribution network (the export tariff) (although generators can opt out of the export tariff if they wish and sell their electricity on the wholesale market).

The Schemes have been a great UK success story and from almost a standing start have propelled the UK to being one of the world leaders in renewables. Since being appointed Secretary of State for Energy and Climate Change on 11 May 2015 however, Amber Rudd individually and the UK government generally has been carrying out a review of the Schemes.

This review has been shaped by a number of factors, some purely political, but includes:

- a 2015 Conservative election manifesto commitment to end any new public subsidy for onshore wind; and

- the acknowledgement by the Department of Energy and Climate Change (DECC) that, for a variety of reasons, it expects to breach the limits of the Levy Control Framework (the LCF) in the absence of measures to control costs (the LCF is the amount of money agreed within government which can be added to consumer bills to pay for low-carbon electricity generation). This had originally been set by the coalition government in November 2012 at £7.6bn by 2020-21 (in 2011-12 prices) but the latest Office for Budgetary Responsibility projections anticipate costs of around £9.1bn (in 2011-12 prices), a 20% overspend, in the absence of measures to control costs.

This has culminated in a number of significant policy changes being proposed in the past three months which present a profound challenge to the renewables sector. These are explored in more detail below.

PROPOSED LEGAL CHANGES TO THE SCHEMES

Closure of the RO to onshore wind

On 18 June 2015, Amber Rudd announced via a written statement to Parliament that the government will close the RO early to onshore wind generating stations from 1 April 2016, subject to allowing certain onshore wind generating stations that satisfy specific eligibility criteria a grace period under which they can accredit under the RO until 31 March 2017 (the precise grace period criteria remain unclear but we have explored the likely elements at the time of writing below). The RO was due to close to onshore wind in March 2017. The draft bill, which was introduced in the House of Lords, will amend the Electricity Act 1989 and the Renewables Obligation Closure Order 2014 to prevent the issuing of ROCs in relation to electricity generated by onshore wind generating stations with accreditation effective date after 31 March 2016.

Closure of the RO to solar PV

Back in March 2015 the RO was closed two years early to large scale solar (subject to certain grace periods) and on 22 July 2015 DECC published its consultation on changes to the RO for small solar PV generating stations (SSGS) (those with an installed capacity of 5MW or below). The consultation response deadline was 2 September 2015 with the following proposed four main changes to the RO expected to be implemented notwithstanding the highly critical industry response:

- subject to 3), the early closure (from 1 April 2016) of the RO across the UK to SSGS and additional new capacity added to previously accredited SSGS;

- subject to 3), the removal (in England and Wales) of grandfathering for generating stations with an accreditation effective date after 22 July 2015. Grandfathering is the policy that once a generating station is accredited and receiving RO support at a certain level/band (eg 1.3 ROCs per MWh (the current RO ground mounted solar PV ROC banding)) it will continue to receive that level of ROC support for the life of the project;

- a one-year grace period (from 1 April 2016 until 31 March 2017) under which new SSGS can (i) gain accreditation under the RO if they satisfy certain grace period eligibility conditions; and (ii) in certain cases, ensure their ROC banding is grandfathered (please see the ROC grace periods for a more detailed explanation); and

- a potential consultation on new ROC bandings for SSGS (with the new bandings expected to result in significant reductions in support levels and potentially be implemented prior to 1 April 2016 making the future deployment of SSGS unattractive).

FIT reform

Following the publication of Parsons Brinckerhoff’s paper on small-scale renewable generation costs, DECC has also proposed substantial changes to the FIT regime.

On 22 July 2015 DECC published a consultation on the removal of the preliminary accreditation and preliminary registration option for SSGS, wind, hydro and anaerobic digestion generating stations under the FIT (meaning that developers will have no certainty on the FIT generation tariff for a generating station until that station is fully accredited under the FIT). On 9 September 2015, DECC confirmed in its response to the consultation that preliminary accreditation will be removed from 1 October 2015.

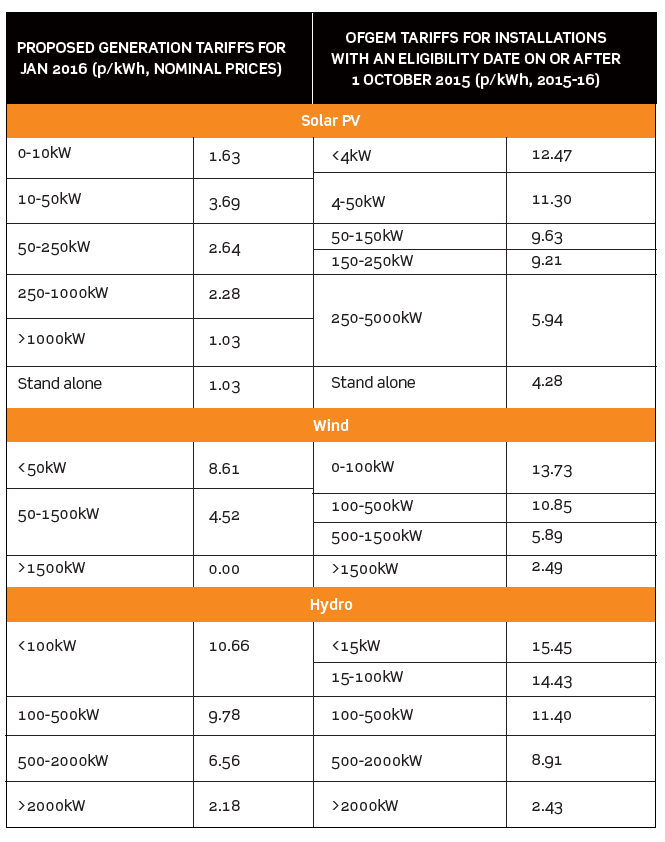

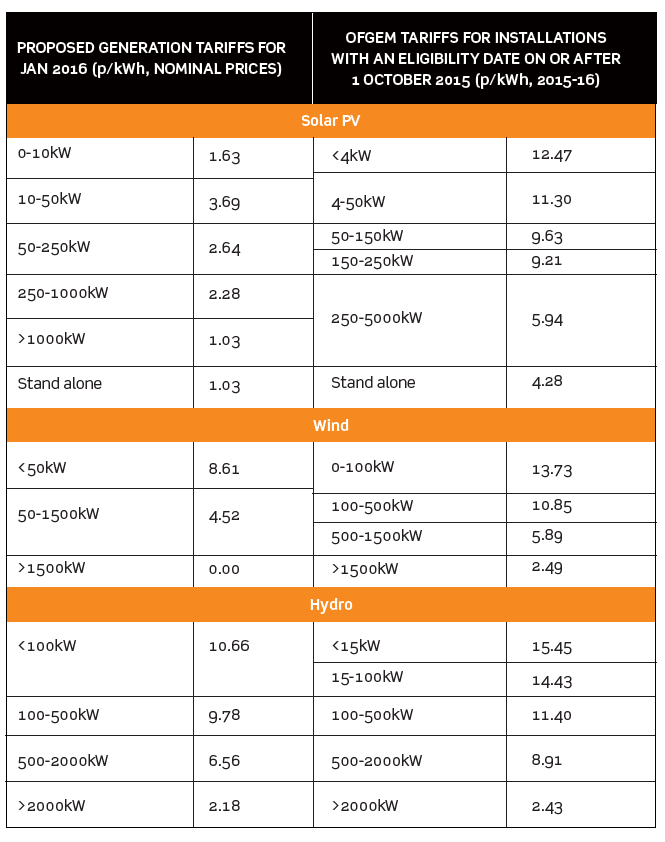

On 27 August 2015, DECC published another consultation proposing (among other things):

- significantly reduced generation tariffs and new tariff bandings for most generating technologies apart from anaerobic digestion generating stations which will be the subject of a separate consultation expected to occur later on this year;

- a quarterly default degression mechanism for all technologies with contingent degression of 5% and then 10% occurring where deployment (across technology and then all technologies together) exceeds specified thresholds;

- potential future changes to the export tariff to ensure it reflects more accurately the wholesale electricity price;

- the generation and export tariffs be indexed by CPI rather than RPI;

- a new overall budget expenditure limit of £75-£100m for the FIT to 2018/19 which will be enforced by a complex system of deployment caps followed by the removal of the generation tariff in 2018/19. The consultation makes clear that the generation tariff could be removed at an earlier date if consultation responses indicate that deployment caps will be an ineffective means of controlling costs;

- a prohibition on new extensions to FIT accredited generating stations;

- not extending the FIT regime to Northern Ireland; and

- that the changes outlined in (a)-(g) above are implemented as soon as legislatively possible (likely to be around January 2016).

The consultation response deadline is 11:45am on 23 October 2015 and a link to the consultation can be found below.

https://www.gov.uk/government/consultations/changes-to-feed-in-tariff-accreditation

The overall picture then would seem to be a brake being very firmly applied to further deployment of renewables under the FIT. Given RO developments and the general shift in government policy, this is likely to have a significant impact on deployment, affecting not only commercial developers, investors and the supply chain, but also community energy projects and individual householders wanting to install and commit to green energy.

OTHER RENEWABLES DEVELOPMENTS

Planning changes for onshore wind

The Conservative onshore wind election manifesto commitment led the government to announce on 18 June 2015 that it was introducing a new planning policy with the stated aim of giving local communities a greater say on decisions in relation to onshore wind planning applications. As a result of this policy, local authorities should only grant planning permission for wind turbines (including community projects) in their area if:

- the site is in an area identified as suitable for wind energy as part of a Local or Neighborhood Plan; and

- after consultation, the planning impacts identified by affected local communities have been fully addressed and the application therefore has their backing.

It is widely predicted that this will result in more application refusals.

The end of LECs for renewable electricity

Unrelated to the review of the Schemes but nevertheless significant, George Osborne announced in the Summer Budget that from 1 August 2015 electricity from renewables projects would no longer benefit from the Climate Change Levy (CCL) exemption.

The exemption had operated to enhance revenue from renewable projects since Levy Exemption Certificates (LECs) could be obtained by a generator and these in turn could be traded alongside other certificates like ROCs with electricity suppliers. The long-term value of the CCL exemption and the longevity of the CCL, had been the subject of much debate in recent years with many licensed electricity suppliers taking a cautious approach. Even so, the announcement has had an impact on financial models and for those with existing projects and long-term power purchase agreements, legal advice is generally being sought on areas such as ‘change in law’ to assess whether the contracts can be or are likely to be reopened.

Affected parties will also be following closely the recently commenced judicial review proceedings by the Drax Group and Infinis Energy (jointly) in relation to the removal of the CCL exemption for electricity generated from renewables. A successful challenge could have a substantial impact on developers’ revenues.

Delay to the next Contract for Difference allocation round

Reflecting the government’s desire to put in place cost cutting measures to ensure the LCF budget will not be breached it is clear that there will be no Contract for Difference (CfD) allocation round this October and we understand that the government will set out its plans in respect of the next CfD allocation round this autumn.

RO GRACE PERIODS

To partially mitigate the effects of the proposed RO changes on investor confidence and prevent a complete hiatus in renewables investment, the government has proposed certain grace periods whereby generating stations that meet specific eligibility criteria will be eligible to be accredited under the historic RO regime.

These grace periods will now be a key factor in almost all construction, sale and financing transactions involving unaccredited onshore wind or solar PV generating stations.

Onshore wind grace period

While no draft legislation has been published on the matter, through a policy paper published on 14 July 2015, DECC has indicated that it is likely to grant a one-year grace period to the closure of the RO to onshore wind generating stations. This would enable such generating stations to be accredited under the RO until 31 March 2017 (when the RO closes to all new generation).

The paper indicates that an onshore wind generating station is likely to be eligible for a grace period where its developer can provide:

- evidence to demonstrate that on or before the 18 June 2015 (in respect of the relevant onshore wind generating station) it:

- had obtained a planning consent; and

- had obtained and accepted a grid connection offer (or the developer can make a truthful declaration that no grid connection offer was required); and

- a director’s certificate confirming that, as at 18 June 2015, it (or the proposed operator of the generating station) owned the land on which the generating station is to be situated, or has an option or an agreement to lease the land, or is party to an exclusivity agreement.

As with all other grace periods that have been introduced to the RO, the detail will be key. This is particularly the case in relation to the application of the planning consent test and whether subsequent amendments to a planning consent/grid connection location will jeopardise an onshore wind generating station’s grace period eligibility.

It also remains to be seen whether the government will listen to the renewables industry and increase the grace period options available for developers to include grid delays and/or delays in obtaining external finance (as a result of the continued uncertainty the government’s policy has caused).

RO solar grace period

Replicating the approach DECC took towards the closure of the RO to large-scale solar, DECC has stated that SSGS (and new capacity added to existing SSGS) will be eligible for a one-year grace period (eg until the full closure of the RO on 31 March 2017) where one of three criteria is met:

- preliminary accreditation under the RO has been obtained in respect of that generating station on or before 22 July 2015;

- the developer can demonstrate that it made a significant financial commitment in respect of that generating station on or before 22 July 2015 by providing Ofgem with;

- the grid connection offer and acceptance of that offer, both dated no later than 22 July 2015;

- a Director’s Certificate signed by the developer or proposed operator of the station confirming ownership of the land, lease of the land, an option to lease or purchase the land, an agreement to lease the land or that the developer or a connected person was party to an exclusivity agreement in relation to the land as of and no later than 22 July 2015; and

- confirmation that a planning application had been received by the relevant planning authority in respect of the generating station no later than 22 July 2015 (or the developer can truthfully make a declaration that planning permission was not required),

at the point of the developer submitting the accreditation application in respect of the generating station; or

- the developer can demonstrate to Ofgem delays in the planned grid connection of that generating station to the local distribution network occurred due to factors outside developers’ control.

Significantly though, DECC has indicated that such generating stations will not then be eligible for the grid delay grace period provided by the Renewables Obligation Closure Order 2014 and that only SSGS that meet the ‘significant financial commitment’ grace period criteria will have their ROC banding grandfathered (although given the potential consultation on new ROC bandings there is no certainty on what the eventual grandfathered ROC banding will be).

This is of vital importance to developers and community projects in that, if they are relying on other grace periods, there is no guarantee that such projects will retain the RO banding that they were accredited with. Accordingly, there is an expectation that this will to lead to developers abandoning (i) almost all unaccredited SSGS that do not fall within the significant financial commitment grace period; and (ii) projects that do fall within the significant financial commitment grace period, but that will be unlikely to be commissioned prior to 1 January 2016 (the potential effective date of the new ROC bandings) as they will have a complete lack of ROC revenue certainty. It is also expected that enhanced due diligence around a project’s eligibility for the significant financial commitment grace period and construction program/Engineering, Procurement and Construction (EPC) contract will be a pivotal factor in any sale or financing transaction.

OBSERVATIONS

While it has always been accepted by the renewables sector that there is a need to drive down costs, the general response has been that the proposed changes to renewables support are extreme, with even the strongest government supporter forgiven for wondering where this leaves the UK’s energy policy. The government’s claim to be ‘the greenest government ever’ is now being increasingly questioned and the gap between electricity generation and demand is getting ever closer; Eggborough, a 2GW coal-fired power station has announced its closure and this follows on from others such as Fawley, Longannet, Tilbury and Didcot.

The reality is that budgets set for ‘clean energy’ (a term the coalition government extended to include nuclear power) were always going to be insufficient to carry on the development trajectory which the new sources of energy (wind, solar PV, AD etc) were on and the government’s primary aim is to balance the economic books. There is a widespread feeling, however, that the way in which it has gone about this with renewables probably also betrays short-term political desires, with numerous commentators querying why, if driving down the costs of new clean energy is the government’s primary aim, the government has: (i) effectively curtailed and targeted the cheapest forms of renewables generation, onshore wind and solar PV; (ii) attacked renewables incentives at a point when certain generating technologies are potentially only a few years away from reaching grid parity level (thereby risking technological developments being abandoned rather than enabling renewables to effectively compete with oil, natural gas and coal generating stations); and (iii) proposed changes to the Schemes that appear to almost totally conflict with the government’s relatively new community energy and ownership policy.

Perhaps of most concern to the sector is the message that many believe the changes send to renewables investors in the UK. The UK has been a stable place to invest in renewables largely devoid of knee-jerk law and policy change. There is a common belief though that the recent consultations and their likely outcomes will harm investor confidence at a time when the main drivers for clean energy will continue for the foreseeable future.

CONCLUSION

The changes proposed and in some cases implemented by the government to the Schemes present a profound challenge to the renewables sector. As a result, making the most of current opportunities will be key to stakeholders, with speed of deployment and grace period eligibility playing a crucial part in almost all new renewable projects. In both cases, sound professional advice will be important to help maximise those opportunities.

By Ross Fairley, partner, and Alec Whiter, solicitor, Burges Salmon LLP.