Some are hailing it as a ‘landmark’ report. Other prominent figures in the business world are saying it is the ‘tipping point’ on climate change – they are talking about the Summary for Policymakers of the fifth assessment report, which was published by the Intergovernmental Panel on Climate Change (IPCC) at the end of September. This report has caused front-page headlines, countless articles in trade journals across industry sectors and a range of commentary from various political figures.

The IPCC is the leading international body for the assessment of climate change and was established by the United Nations Environment Programme (UNEP) and the World Meteorological Organization (WMO) in 1988. Its mandate is to:

‘… provide the world with a clear scientific view on the current state of knowledge in climate change and its potential environmental and socio-economic impacts’.

The report itself has 259 authors from 36 countries. It also has around 800 scientists that have contributed in total and thousands of bodies have reviewed it. The IPCC only collects the contributions and does not itself conduct studies.

The large amount of attention on this report is due to the alarming nature of its findings. In particular it reports that it is ‘extremely likely’ that humans are the dominant influence on climate change and that climate change is happening at a more dramatic pace than previously understood.

The IPCC report indicates that it is becoming abundantly clear that climate change is not just a humanitarian issue. This article touches on some of the top issues for businesses in light of the most recent findings in the IPCC report and discusses how an economic case for addressing climate change is becoming undeniably important for success in the future.

SCIENTIFIC GAME CHANGER

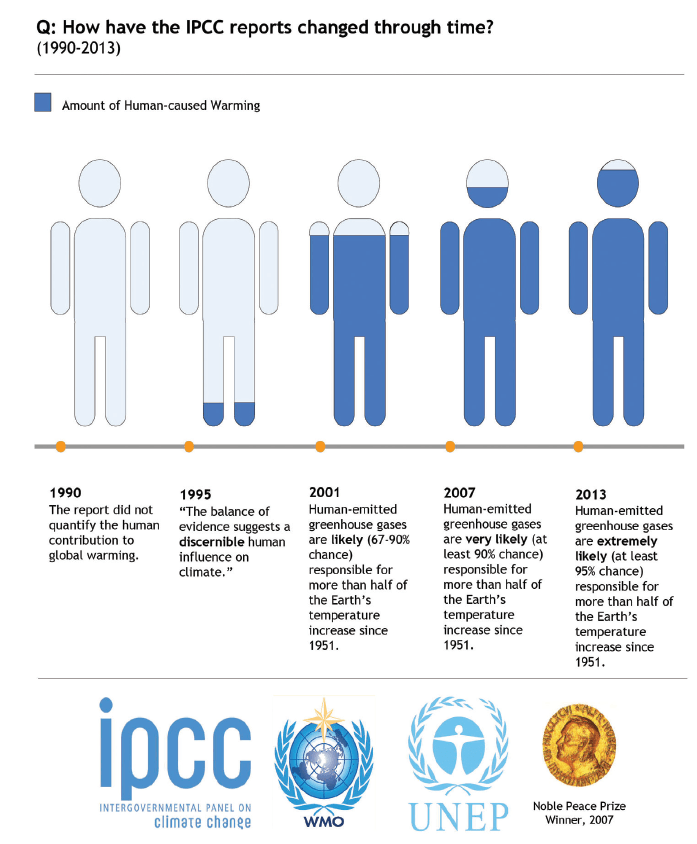

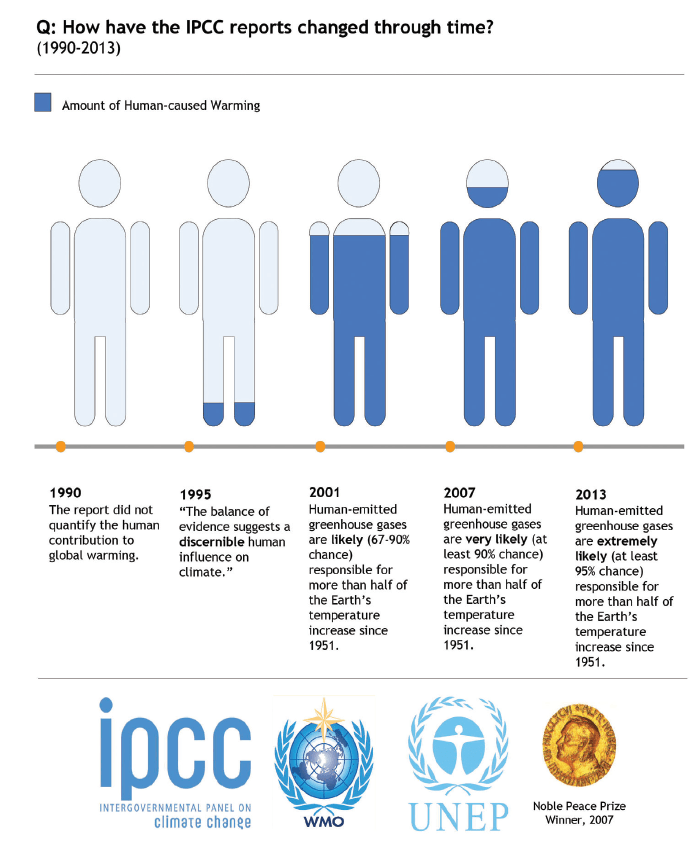

With advances in paleoclimate reconstructions and improved climate change modelling, scientists are now able to more accurately assess the degree and causes of climate change. The graph opposite, as published by the IPCC, demonstrates the significance of the findings in the IPCC report by comparing historic reports it has published on the impact of humans on climate change.

The analysis in the report is based on a range of modelling and data on warming oceans and atmospheres. Outside of the scientific community and academia the temperature of oceans and the size of icebergs may seem completely irrelevant to businesses and corporate operations. In fact, some sceptics of climate change have taken the stance that a warmer climate may not be such a bad thing and are naming ‘benefits’ such as more sun in typically cold rainier climates and longer growing seasons. This is, however, where the climate change discussion goes from being an issue of understanding science to one of applying economic and political principals related to the impact of climate change on supply, demand and resource security.

CLIMATE CHANGE: THE HUMAN FACTOR

Those who have made attempts at painting the impact of climate change in rosy colours of warmer and sunnier times with increased periods for growing crops risk ignoring the connectivity of modern societies and businesses in this picture. For humans in high-risk areas of the world, scarce resources and land could lead to conflict and massive displacement of peoples. Much like the financial crises that started in the US and is still impacting the entire world, the regional impact on humans in the most at-risk areas of the world would have an unavoidable global impact on business and economies.

BATTLEFIELD EARTH

James Valvo (director at the advocacy group Americans for Prosperity, funded by the Koch brothers) makes the argument that efforts for capping or curbing emissions are antiquated as jurisdictions are now focused on mitigation efforts. However, counter to this, the results of the IPCC report show a forecast of the collapse of the monsoon cycle in Asia in the near future and stressed out crops in the corn belt of the US. Both of these events could impact the economies all over the world well before mitigation can be sufficiently implemented. It has been said that, of all the commodities in the world, food is one of the most political. This is exemplified by the fact that many revolutions of the past few years were started over food shortages. What the report emphasises is the likelihood of water scarcity combined with stressed crops creating more wars over food and water in the lifetime of our children than any other cause. The message is that something will have to be done to halt the global warming alongside both mitigation and adaption efforts. The most positive news in the IPCC report is that, while the situation is dire, it is not too late.

RISKY BUSINESS

When a business is considering an acquisition, entering a new territory or starting a new operation, risks in relation to resource availability, political stability and supply chain security are typically a priority in their assessment. The impact of climate change touches a myriad of areas in relation to the standard risk assessment matrix. It is clear from the IPCC report that certain jurisdictions of the world will be more exposed to climate change and, with the global nature of business operations, it is vital to consider how changes in these regions could impact operations on a global scale from local resources to the full international supply chain.

It is not only risk models and due diligence procedures that will need to be restructured to consider climate change. Investment decisions will increasingly need to incorporate considerations related to climate change as well. Could assets be stranded as a result of a government continuing to put caps on emissions? Analysts report that many global corporations are at risk of having stranded assets associated with climate change, water shortages, resource scarcity, policy changes and shifts in consumer/social norms. The issue is that investors often value assets over the short-term, with a quick exit envisioned. Climate change risks however are both short term and long term in nature and, once the assets are stranded, there may be little or no option for an exit at the expected value.

Risks can be increased further where the impact on a business’s brand is considered. Brand can be a valuable asset and consumers are increasingly aware of and react to how they perceive a business deals with scarce resources in volatile jurisdictions.

Unfortunately, addressing and incorporating climate change risk strategies into business models will require more than reading and understanding an IPCC report or implementing a corporate sustainability programme. It will most likely also require a mapping of the climate change risks in applicable jurisdictions, identifying how this impacts operations and where/when it should influence investment/divestiture decisions. In an attempt to assist investors, policy makers, local governments and stakeholders in understanding the economic impacts of climate change in the US a new project is underway. It has been appropriately named ‘Risky Business’, and it is a collaboration between a Republican George Schultz (the former secretary of state under President Bush) and a billionaire Democrat, Tom Steyer (the founder of Farallon Capital Management LLC, a San Francisco hedge-fund firm with about $20bn in assets). The Risky Business project is directed by a team of ten multidisciplinary economists and climatologists. It has an aim of making an economic case for addressing climate change. The project divides the US into eight regions, and then will determine the probability of a range of outcomes that result from climate change. The aim is not to provide solutions but to provide investors, policy makers, businesses, farmers, and consumers with data that can be actually used to understand climate change in their region.

COLLABORATION IS KING

One of the most challenging aspects of addressing climate change is its global nature. It is easy to discount the potential impact by taking a view that where there is no obvious or known direct impact on operations there is no need to participate in adaptation or mitigation efforts. However, merely being located in a geographic area with secure resources does not necessarily mean that operations are safe from climate change risks. For example, a high street sandwich shop in the UK may buy its wheat from the central US, its beef from Argentina, and its coffee from Brazil. It may have fairly stable water resources and energy, but its supply chain is most likely highly exposed to climate change risks. The one way to identify and understand these risks is by implementing climate change accounting methodology alongside financial risk accounting.

Coca-Cola is leading the way from a corporate perspective in addressing climate change risk along with addressing a number of other key sustainability issues in its operations. It has developed a first-of-its-kind water footprinting methodology. Using the results from this footprinting it has also developed revolutionary water preservation protocols. Because water scarcity is a very large risk that requires attention by corporates and governments on a global scale in a collaborative effort, Coca-Cola is preparing to release the protocols to the public free of intellectual property rights as a way to support water-preservation efforts globally.

Many international non-governmental organisations like the World Wildlife Foundation, Partners for a New Beginning, as well as state-sponsored aid organisations like the US Aid and the Inter-American Development Bank are teaming up with corporations keen on investing in climate change mitigation and adaptation projects. This has helped to create projects of scale and to increase beneficial collaboration as a means of obtaining more effective long-term results.

GREEN MARKETS TO GREEN GROWTH

The IPCC report is a strong indication that policy makers, governments and industry sector associations will continue to take action to address climate change risks. It is likely that they will choose a market-based mechanism to cut emissions and to incentivise green technological advances as this has been a growing trend. These schemes include emissions trading and other energy efficiency financing schemes, as well as green power source incentive schemes. While it is not clear this will be the case in the UK or Australia, many other jurisdictions are moving very swiftly to implement carbon market schemes. China is set to have a national scheme in place by 2015. South Africa, South Korea and Brazil are all setting up carbon markets. This is in addition to the already functioning and linked markets between Quebec and California. Additionally, both the aviation and maritime sectors, after a period of analysis, are leaning towards the use of market mechanisms to reduce emissions and incentivise green technological advances in their respective sectors.

What does this means for business? Where market mechanism and schemes start to overlap, it points towards a huge increase in compliance costs for business. Additionally, it has proven very difficult to create a flexible mechanism that is capable of being responsive to the business case required to create incentives for green growth in technology and projects. Just as infrastructure projects in the great depression leveraged recovery, renewable energy and emissions reduction projects not only mitigate climate change issues, but they could also contribute to economic recovery. Even though governments are starting to push towards this solution, the green job movement has gathered some momentum, and market-based mechanisms are meant to provide the financing required, developers still report that the burdensome licensing, permitting and approval processes are crippling projects in the green sector.

AN EARLY STARTER ADVANTAGE

A recent study conducted by Coca-Cola shows that less than a quarter of corporate boards in the EU consider sustainability issues. One of the strongest factors in driving corporate sustainability efforts is support from senior leadership. Leaders in the insurance industry and global assurance companies have been providing a consistent message for the past few years now that there is a lack of focus on climate risks at a senior management level in organisations around the world. Incorporating environmental footprinting information as well as climate change risk assessments into corporate management strategies will still provide an early-starter competitive advantage as proven by Unilever, Maersk, and Coca-Cola, to name a few.

CONCLUSION

As the financial crisis hit the US at the end of 2008, some thought that it was not a global issue and would be regionally isolated. There are analogous views in relation to climate change. Climate change critics have a very alluring business-as-usual argument. Just as the financial crisis could not be contained, the IPCC report suggests neither will the impact of climate change, unless governments act on the growing demands on them to take action.

From a legal perspective, this means that, as governments and business become fully conscious of climate change issues, it is likely that there will be an increase in the complexity and liability under regulations. Given the current volume of science on climate change and the vast array of research and analysis of its economic impact that is now available, it is also likely that investors will soon start asking more questions around climate change and requiring that it is included in risk models. Further, because of the demands from investors and consumers to address climate change risks and to make climate-conscious investment decisions, being knowledgeable and sensitive to the relevant climate change issues to a business could prove to be a real value-add from in-house counsel when providing advice to senior management.

By Rachel Blackburn, associate, Burges Salmon LLP.

E-mail: rachel.blackburn@burges-salmon.com.