Adapting Mexican corporate governance policy related to new market realities would need corporate law reform with the backing of enforcement. Nevertheless, certain local instruments – which lack binding force and which may, at best, fit in the category of ‘soft law’ – attempt to direct corporate practices through a voluntary approach. This is the case with the Código de Mejores Prácticas Corporativas (Code of Best Corporate Practices), which was issued by the Consejo Coordinador Empresarial (Business Coordination Council) and follows the OECD Principles of Corporate Governance, first published in 1999. On the other hand, the legal framework tackling the topic is condensed into two bodies of law, namely, the Ley General de Sociedades Mercantiles (Commercial Entities General Law) and the Ley del Mercado de Valores (Securities Market Law), both of which deal with, inter alia, the liabilities of directors and boards, the independence of the latter, and minority rights.

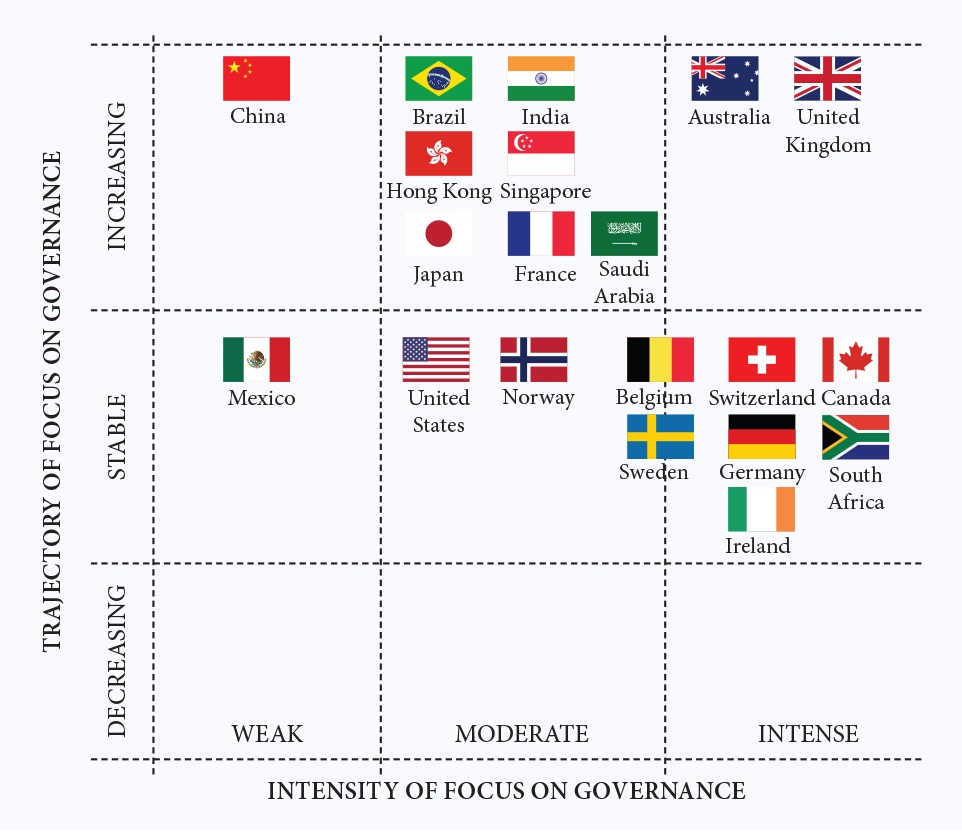

In recent years, Mexican multinational companies, non-profit organisations and small and medium-sized family businesses have made progress. There are, however, some significant shortcomings across Mexico, in comparison to the aforementioned OECD principles, as shown on Figure 1 below, from 2018 Global Trends in Corporate Governance by Farient Advisors & Global Governance and Executive Compensation Group.

Figure 1

Mexico, as an emerging market, lacks strong corporate governance practices mainly due to: (i) centralised ownership; (ii) business cartelisation; (iii) insufficient regulation of accounting requirements; (iv) poor information transparency, and (v) a relatively limited number of securities market transactions.

By analysing the structure and corporate governance regime of several Mexican multinational companies through the six main corporate governance aspects (ie average number of directors, independent membership, average age, educational background, corporate structure and investor voting rights), it is possible to obtain a better understanding of the matter.

Average number of directors

Board conformation is a wide interest area for investors, due to its strong relationship to shareholder representation and the strategic role they play in the company. To become an agile and efficient board, shareholders have to consider company’s size and maturity to define the right number of directors. The average board in Mexico, as of 2018, had 11.6 directors, compared to the average of 13.8 on Germany. However, some of Germany´s biggest companies only have seven directors on their boards, which reflects that board composition can vary depending on company’s specific needs and principal-agent relationships.

Independent membership

Independent board members are known for helping companies avoid conflicts of interest and incentivising better decision making. Under the Securities Law, a board of directors must be composed of no less than five and no more than 21 board members, 25% of which are required to be independent directors; in contrast, in countries such as Finland, Denmark and Germany, the percentage is about 80%.

Directors’ average age

In Mexico, the average age of a member of a board of directors is 59, while the average age of chairmen is 58. CEOs’ average age in Mexico is around 50 years old.

Comparing these numbers with averages in some of the most advanced European countries, directors’ average age in Mexico is close to that in Germany (58) or Finland (58.5).

Educational background

One quarter of companies’ directors in Mexico are engineers, followed by 20% of business administrators, of which 45% studied industry-specific programmes. Other common graduate and postgraduate studies of Mexican directors are related to accounting, economy, law and finance.

Board committees – structure and composition

Mexico’s best corporate governance practices recommend companies consolidate their corporate governance with an audit committee, whereas in other countries regulations make these committees mandatory (even including some others, such as a compensation committee or a nominating and governance committee).

According to Deloitte’s Sixth Best Corporate Governance Practices Studio, a survey of a wide range of Mexican SMEs, 66% have an audit committee, 56% a finance committee and 44% a risk committees.

Investor voting rights

As mentioned above, Mexico has enacted (mainly for listed companies) operational rules that define important interventions and influences of the shareholders in the decision making of a company through corporate governance, such as director elections, auditor selection, shareholders rights, and board structure. Despite this, those important aspects are not widely practiced in non-regulated companies. It is important to stress that in Mexico, a director or the board is significantly less powerful than in other countries.

Conclusion

Mexico has worked through the years to become one of the strongest countries in America in corporate governance matters, starting with the first Code of Best Corporate Practices to the latest amendments of 2018. From a legal point of view, Mexico has developed a mandatory framework for publicly listed companies with requirements that contribute to a safer and more attractive market, with policies particularly focused on establishing and implementing several mechanisms to avoid liabilities from a civil, commercial, tax or criminal standpoint. Furthermore, the Code of Best Corporate Practices addresses in more detail the complementary elements of corporate governance, encourages investment and develops a more stable and trusted economy.

When analysing Mexico’s current position, we need to think creatively about incentives that may foster the inclusion of non-regulated companies into corporate governance, by showing that such controls and mechanisms will generate value to investors and shareholders on the long term. Mexico has a long way to go, however, there are some political changes that can shape the business and compliance environment in the country (mainly from a tax and regulatory standpoint).

With a large number of family businesses, Mexico can become a governance world leader institutionalisation guidelines, better decision-making procedures, and adequate wealth management and succession planning.

Finally, trending topics such as gender equality, workers´ union representation, remediation of conflicts of interest, anti-discrimination, anti-money laundering, transparency, and governmental independence rules, are becoming highly relevant for shaping the corporate governance structures in Mexico in the near future.

Deloitte Legal,

Paseo de la Reforma 505, Piso 28,

Colonia Cuauhtémoc, C.P. 06500,

Mexico City, Mexico, Marketplace México-Centroamérica,

Spanish Latin America

T: +52 (55) 5080 6000