Introduction

A weak Yen and other factors continue to attract overseas investors to the Japanese real estate market. While this investment can take many forms, two of the most common financing structures are GK-TK and TMK (as defined in the graphics). J-REITs are often used for large-scale portfolios, but because of this structure’s longer timeline and complex setup, this article will focus on the GK-TK and TMK investment forms. We explain these two structures below.

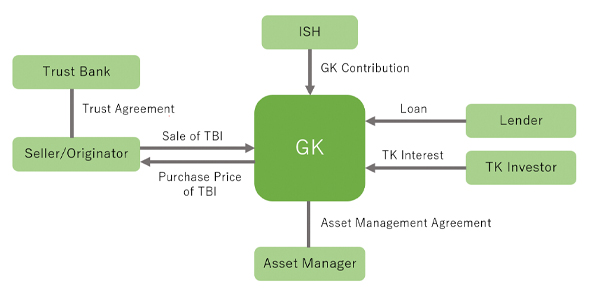

GK-TK structure

(i) Summary of GK-TK structure

The GK-TK structure uses a godo kaisha (‘GK’) as a special purpose vehicle to hold a trust beneficiary interest in the subject property (in the context of the GK-TK structure, the GK is sometimes referred to as the ‘TK operator’). GKs are used as the property holder because, among other reasons, their corporate structure is simple and flexible under the Companies Act, and they are not subject to the Corporate Reorganisation Act and thus cannot file for or be included in corporate reorganisation proceedings. The GK-TK structure thus eliminates the risk that the lender will not be able to foreclose on its loan collateral due to corporate reorganisation procedures.

Tokumei kumiai (‘TK’) is the name of the contractual relationship between the GK and its investors (such investors, ‘TK investors’). In a tokumei kumiai keiyaku (‘TK agreement’), which is commonly translated into English as ‘silent partnership’ (so called because control and management rights are vested in the GK), a TK investor invests with the GK in exchange for a certain portion of the profits and losses of the GK’s business (‘TK business’). Where the GK has more than one TK investor, it will enter into a separate TK agreement with each.

Since the TK business is operated by the GK and does not involve the TK investors, the GK as TK operator will own all property of the TK business and bears unlimited liability for all obligations of the TK business. Accordingly, all of the TK business is subject to the claims of the GK’s creditors. The liability of the TK investors, however, is limited to their investment. It is in part this limited liability that makes the GK-TK structure attractive to investors, in addition to the pass-through tax treatment.

(ii) Application of FIEA to GK-TK

A) TK operator (ie, the GK)

1. Self-offering of TK interests

TK interests are essentially regulated under the Financial Instruments and Exchange Act (‘FIEA’) as quasi-securities. The TK operator is therefore generally required to register to self-offer or solicit TK interests under the GK-TK structure, and a special purpose vehicle with one independent director and no employees, like the GK, is unable to satisfy these requirements.

There are, however, exemptions to these registration requirements. Under one such exemption, if any of the TK investors is a qualified institutional investor (‘QII’), and if certain other conditions are met, eg a limitation on the number of non-QII TK investors, then the TK operator is exempt from registration under the FIEA.

Even if the requirements of this QII exemption for self-offering cannot be satisfied, the TK operator can be exempted from the requirement to register if the TK operator entrusts the offering of TK interests to a registered second-type financial instruments firm. No filing is required to be made by the TK operator in order to take advantage of this exemption.

2. Self-management of TK investment funds

In addition, the management of funds raised through TK arrangements is subject to the FIEA, and where the TK operator elects to self-manage the TK investment funds, it is required to register to conduct discretionary investment management business. However, a special purpose company like the TK operator is not practically able to satisfy the requirements for such discretionary investment management business registration.

Similar to the exemptions available in the case of registration for self-offering, if any of the TK investors qualify as QIIs, the TK operator is not required to register as a discretionary investment manager even where it self-manages the TK investment funds, provided that certain other requirements (such as limitations on the number of non-QII investors) are satisfied. The TK operator must still notify the FSA that it falls within this QII exemption for self-management.

Entrustment of the management of the TK investment funds to a registered discretionary investment management firm, as well as meeting some additional requirements, will also exempt the TK operator from registration. Certain notifications to the FSA of the intention of the TK operator to apply this exemption is required.

B) Asset manager

An asset manager that offers investor advisory services to a TK operator is required to register as an investment advisor. Where the asset manager is given the authority and power to make decisions on buying and selling the investment assets, however, that asset manager is required to register as a discretionary investment manager.

If an asset manager also negotiates on behalf of the TK operator in offering TK interests, that asset manager will need to be registered to conduct second-type financial instruments business.

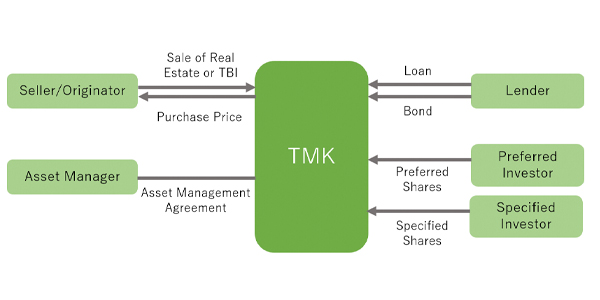

TMK structure

(i) Summary of TMK structure

A tokutei mokuteki kaisha (‘TMK’) is similar in many ways to a joint-stock corporation, which is the Japanese equivalent of the US corporation. The TMK structure allows for, among other things: (i) issuance flexibility with respect to a variety of securities reflecting different levels of risks and returns; (ii) subject to compliance, elimination of typical joint-stock company double-taxation treatment; and (iii) certain tax advantages at time of acquisition of real estate (eg, registration and acquisition taxes is discounted from the standard rates).

Unlike a joint stock corporation, a TMK is limited in purpose to holding and disposing of an asset in an asset securitisation arrangement, and therefore relies on outside service providers for operational, management and dispositional functions. The members of the TMK, which are the equivalent of shareholders of a joint stock company, have the ability to participate in governance and decision-making, however, distinguishes the TMK from the GK-TK structure, where the TK investors must remain ‘silent’ and thus cannot participate in management decisions with respect to the TK business.

(ii) Application of FIEA to TMK

The FIEA imposes fewer regulatory restrictions on the TMK than on the GK-TK structure. A TMK falls outside the scope of the FIEA with respect to self-offering and self-management and thus is not required to register for these activities.

With respect to asset management, a TMK’s asset manager is not required to register if the investment asset is real estate, even where management of the real estate to such asset manager. Where the investment asset is a trust beneficiary interest, as in the case of the GK-TK structure, whether the asset manager has to register as investment advisory or discretionary investment manager depends on the scope of decision with which it is entrusted.

Conclusion

The foregoing are some of the most important factors foreign investors might want to take into account in deciding on an investment structure as between TMK or GK-TK with respect to Japanese real estate. In particular, the FIEA regulatory structure applies to these structures differently, with the TMK being subject to fewer regulatory requirements, and the GK-TK structure dependent on meeting certain crucial exemptions.