Gigantic noticeboard or wall of graffiti? Online libel: are we lost in analogy? | Schillings

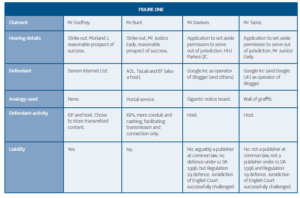

Following the recent High Court decision in Tamiz v Google Inc [2012], which closely followed the decision by HHJ Parkes QC in Davison v Habeeb [2011] just two months earlier involving the same defendant, you may have been mistaken for thinking that the law was for once attempting to move at the pace of technology. …

Continue reading “Gigantic noticeboard or wall of graffiti? Online libel: are we lost in analogy?”