Recent years have seen global shifts in both policy frameworks for screening inward foreign direct investment (FDI) and the way in which those frameworks are applied. The result is a more uncertain environment for foreign investment, which parties to a transaction will have to consider how to navigate earlier in the transaction process.

1. What is W&I Insurance?

As the name suggests, W&I insurance provides financial cover to the insured in the event of a breach of warranty or a claim under a tax indemnity.

The W&I policy can be held by either the seller or the buyer. While it is much more common for W&I insurance to be placed on the buy-side, it is often the seller that introduces the idea of insurance to the deal. The advantage of insuring the buyer (rather than the seller) is that it allows a direct claim to be made against the insurer, avoiding the need to pursue the seller. In turn, this allows the seller to cap its liability at a low level under the SPA (typically between 0-1% of the enterprise value of the target business).

2. Why is W&I insurance gaining traction on corporate transactions?

The use of W&I insurance can have benefits for both buyers and sellers.

On the sell-side, W&I insurance allows sellers to ensure clean exits. In the corporate setting, the product is frequently used in the context of carve outs or sales of distinct business units, especially when the funds from such divestitures are required elsewhere in a group. In such situations, it is not uncommon to find that the sellers do not have day-to-day knowledge about the target – and therefore, feel uncomfortable giving the warranties. Conversely, management who have dealt with the day-to-day affairs of the business often do not have equity and are, therefore, unwilling to stand behind the warranties. As such, W&I Insurance can be used to great effect to bridge this gap and give either the seller or the management team the comfort required to provide the warranties – either by permitting them to cap their liability at a very low level (often at £1) or by enabling them to give warranties on a blanket knowledge-qualified basis. Through the W&I policy, the insurer will disregard the liability cap and provide coverage up to the agreed policy limit. Insurers can also disregard the blanket knowledge qualifier and provide coverage for the warranties on an unqualified basis (subject to an additional premium and comfort that due and careful enquiry has been made of the management team).

On the buy-side, there are three principle benefits for corporates:

- It allows the buyer to claim against an ‘A’-rated insurer. This is of particular importance where the corporate is buying from individuals or funds whose financial covenant is weak.

- When buying from private equity houses, it enables buyers to push for warranty protection where, in the absence of insurance, none would be offered.

- It can give buyers an advantage in a competitive auction, by allowing the buyer to reduce the seller’s liability in their SPA mark-up and thereby make their bid more attractive.

3. How do insurers get comfortable with taking on these risks?

The majority of insurance underwriters are now ex-corporate lawyers or investment bankers who have hands-on experience of running M&A processes. As such, while the underwriters are not experts in the underlying sector/assets, they are able to look at how the parties have conducted the transaction to ensure that a thorough due diligence and disclosure process has been undertaken. The knowledge that a comprehensive diligence process has been carried out is key to providing insurers with the requisite comfort to take on the liabilities under the warranties and the tax indemnity.

As part of their underwriting process, insurers will require access to the virtual data room and, on a non-reliance basis, the due diligence reports that have been prepared for the transaction. At a minimum, insurers will expect there to be legal, financial and tax due diligence. These reports should be in written form and prepared by professional external advisers or, if internally prepared, by people who are highly experienced in their respective field. It is worth noting that insurers will be anxious to see that insurance is not being used as a replacement for thorough due diligence and, as such, it is essential to show that the matters covered under the warranties/tax indemnity are verified, where possible, by the due diligence reports.

4. How much cover is usually purchased and what does it cost?

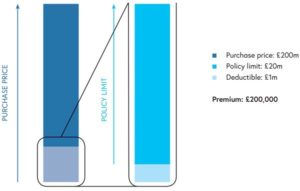

We typically see policy limits in the region of 10–30% of the enterprise value. The premium is expressed as a percentage of the policy limit – this is known as the ‘rate on line’. The premium is a single one-off payment for the entire policy period and is normally due shortly after closing. By way of illustration on a £200m transaction, a 10% policy limit represents £20m of cover. At a ‘rate on line’ of 1% (which is a good rough guide for operational businesses in the UK), this would represent a single premium payment of £200,000.

Insurers will also apply an excess to the policy. Historically this was set at 1% of the enterprise value for European targets. However, increased insurer competition has driven excesses down and it is now common to obtain an excess of 0.5% of the enterprise value.

A de minimis will also apply to each claim under the policy. This typically matches the de minimis applied under the SPA. However, it is important to note that insurers will expect the materiality threshold applied to the due diligence reports to be the same as or lower than the de minimis.

The insurer will set a timeframe within which claims can be made for a breach of warranty or claims under the tax indemnity – this is the policy period. The policy period is normally two years for general warranties, seven years for tax warranties/a tax indemnity and seven years for title and capacity warranties. It is worth noting that these time periods do not need to reflect the commercially agreed position under the SPA.

5. How does cover under the W&I policy differ from the cover provided under the SPA?

While W&I insurance is an incredibly helpful tool for the reasons explained above, it is essential that buyers understand that the cover provided by W&I insurance does not precisely replicate the cover typically provided by a seller under the warranties or a tax indemnity.

W&I insurance is designed to cover unknown risks. As such, any matters fairly disclosed within the due diligence reports, the SPA/disclosure letter or within the virtual data room typically qualify for cover under the policy.

W&I policies also include standard exclusions from cover. The precise list of exclusions varies from insurer to insurer and from transaction to transaction (depending on the sector/nature of the underlying asset). However, as a general rule, the following matters are excluded:

- the non-availability of carried-forward tax assets post policy inception;

- issues actually known to the insured at policy inception;

- matters fairly disclosed within the virtual data room or due diligence reports;

- forward-looking statements;

- leakage/purchase price adjustments;

- secondary tax liabilities;

- transfer pricing;

- physical and structural defects/condition of assets;

- pollution;

- pension underfunding risks; and

- fines and penalties which are uninsurable by law.

In addition to the above, insurers will often attempt to exclude liability for, where relevant, issues such as professional indemnity, product liability and cyber security. The argument here is that the target should have existing policies in place to cover these risks and should not be relying on the W&I policy to provide such protection. However, provided the broker can supply the insurer with the existing policies or evidence that the existing policies are adequate and robust, many insurers can get comfortable with providing cover for these issues (sitting in excess of the limits on the existing policies).

Given the potential limitations mentioned above, we have seen a significant increase in the use of specific risk policies (ie policies covering specific matters identified during a diligence process) over the last year. These policies are particularly prevalent in relation to tax risks identified during the due diligence process.

6. What is specific tax risk insurance?

Specific tax risk insurance provides financial cover to an insured in the event of a successful challenge by a tax authority on a specified tax risk. In addition to the disputed tax, the policy can provide cover for associated interest and penalties, and the external legal costs of the insured incurred as a result of defending a tax authority challenge.

7. When is specific tax risk insurance used?

In the context of M&A transactions, we find the product is typically used either where the quantum of a known tax risk sitting within the target group is of such magnitude that the seller and buyer cannot agree between themselves on an acceptable risk-sharing allocation, and the transfer of the known tax risk to the insurance market is the only way to facilitate the deal, or, where the buyer is seeking to price-chip the seller in respect of a known tax risk and, as an alternative to the price chip, the seller sources an insurance policy for the benefit of the buyer.

Specific tax risk insurance can also be used outside of a transactional context. We are increasingly seeing corporates explore the use of the product as means to hedge tax risk they would otherwise be carrying on balance sheet. As an example we have recently worked with a large corporate to arrange insurance cover for a known tax risk arising from an internal group restructuring.

8. What types of tax risk are insurable and how much does it cost?

Insurers will look to a number of factors when assessing the insurability of a known tax risk including, but not limited to, the nature of the tax risk, the relative strength and legal basis of the tax position taken, the perceived likelihood of an audit into the risk arising and the jurisdiction of the risk.

The outcome of the increasingly commercial approach being taken by tax insurers is that tax risk is now insurable across most European jurisdictions provided that the risk is classified as either low or medium risk (high risk is still typically uninsurable).

Pricing for specific tax risk insurance is very much fact dependent and will vary from risk to risk. The rate on line is typically 2%-6% of the policy limit, depending on the risk.

9. What other M&A insurance products are available?

The creative application of insurance is continuing apace, eradicating the traditional view that insurance is only relevant to a limited selection of clients and situations. There are three insurance products, in particular, that we are seeing increasingly used in the context of M&A transactions: (i) litigation buy-out; (ii) environmental; and (iii) title/legal indemnity insurance.

- Litigation buy-out insurance is used to cover losses arising from a litigation process that a target business is involved in at the time of an acquisition. Insurers will typically only insure ‘low-risk’ litigations, with the policy providing the greatest benefits when buyers and sellers simply cannot agree on how to allocate such risks. A recent example saw the target business in question have historic involvement in a cartel. The target had whistle-blown and gained immunity from the relevant authorities, while the other cartel participants all received fines. These participants clubbed together and sought to challenge the immunity of the whistle-blowing target. The challenge was ongoing during the acquisition process, and on the strength of two legal opinions, Howden was able to structure a policy that saw the buyer indemnified for losses suffered in the event the challenge was successful. Pricing can range from 5-15% of the policy limit, depending on the nature and jurisdiction of the risk.

- Environmental insurance is used to cover both known and unknown pollution events, typically for manufacturing businesses. While W&I insurance will typically cover legal environmental matters (correct permits etc), it often excludes pollution/clean up matters. Environmental insurance is a useful tool to supplement W&I insurance and provide such cover. Pricing ranges from 1-5% of the policy limit.

- Title/legal indemnity insurance is used to cover both known and unknown matters surrounding title to shares or assets. While historically a product primarily used on real estate transactions, we have seen a significant upward shift in the use of the product on operational transactions, in particular where real estate contributes a significant portion of a target business’ value or where the covenant strength of a seller is questioned. The product can also be used to streamline due diligence processes, with title insurers happy to provide cover to share and asset ownership of a group when only a 10-20% sample has been diligenced.

In addition to the above, recent innovation within the insurance market has resulted in the advent of new products, such as break-fee insurance. Break-fee insurance policies are designed to provide protection to a buyer in the event that it becomes liable to pay a break fee to the seller as a result, for example, of a transaction not proceeding to completion because regulatory approval is denied.

We anticipate that the insurance market will show a continued commitment to innovation and that insurance will increasingly provide an efficient way to unlock difficult negotiations and manage risk on M&A transactions.

We anticipate that the insurance market will show a continued commitment to innovation and that insurance will increasingly provide an efficient way to unlock difficult negotiations and manage risk on M&A transactions.

10. Are corporates already using this?

We spoke to the general counsel at Spirax-Sarco Engineering, Andy Robson, on his experiences of using M&A insurance in a corporate deal context and why he believes it is already an essential component of the M&A process.

Spirax‐Sarco Engineering plc comprises two world‐leading businesses, Spirax Sarco for steam and electrical thermal energy solutions and Watson‐Marlow Fluid Technology Group for niche peristaltic pumps and associated fluid path technologies. It is a FTSE250 company (currently on the FTSE100 reserve list) and has experienced high growth over recent years, driven both organically and via a number of strategic acquisitions. The company made three significant acquisitions in 2017, including the Pittsburgh-based thermal technology company Chromalox Inc for $415m and the German-headquartered boiler control systems business, Gestra, for €186m. The company used W&I insurance on both of these transactions.

What are your general thoughts on M&A insurance, having used the product on your recent acquisitions?

In my view it is a must have if an organisation is engaged in international M&A, especially when acquiring good assets from private equity houses. Private equity houses have very little appetite for providing business warranties and this is one way of providing yourself, as a buyer, with an acceptable level of protection. For the mid-sized and larger transactions it is almost seen as a market standard, with the investment banks including a requirement for W&I very early on in the sale processes. It should also be high on the agenda when there is any uncertainty about the covenant strength of a seller.

You’ve used W&I insurance on the buy side, have you considered using it on the sell side?

If you are in-house counsel with a blue chip company and a sale means the company taking on long–term liabilities, I expect boards will be asking why the company is not taking advantage of M&A insurance to curtail these liabilities. It is especially relevant when considering the sale of a distinct business unit, where the seller might have had little day-to-day involvement in the management of the business, and as such will be looking to limit its liability under the SPA.

Do you have any advice for lawyers within in-house legal functions on the use of the products?

I would encourage them to get familiar with the M&A insurance products that are available in the market and begin to integrate them into their transactions from an early stage. It would be a mistake to view M&A insurance as a secondary consideration.

Instead build time into the process to engage with an experienced broker and make the most of the independent review and advice that they can offer.